How to Qualify for Hard Money Loans In Georgia and Obtain Moneyed Fast

How to Qualify for Hard Money Loans In Georgia and Obtain Moneyed Fast

Blog Article

Understanding How a Hard Money Car Loan Can Help You in Realty Purchases

In the realm of realty financial investment, recognizing the subtleties of hard money finances can dramatically enhance your financial method. These lendings, which highlight residential or commercial property value over standard debt metrics, offer a distinct chance for capitalists facing time-sensitive choices or those with unconventional economic backgrounds. As we explore the crucial advantages and possible risks of difficult money funding, it comes to be apparent that while these car loans supply a swift path to resources, they additionally carry unique risks that require mindful consideration. What elements should you weigh prior to going with this financing method?

What Is a Difficult Cash Lending?

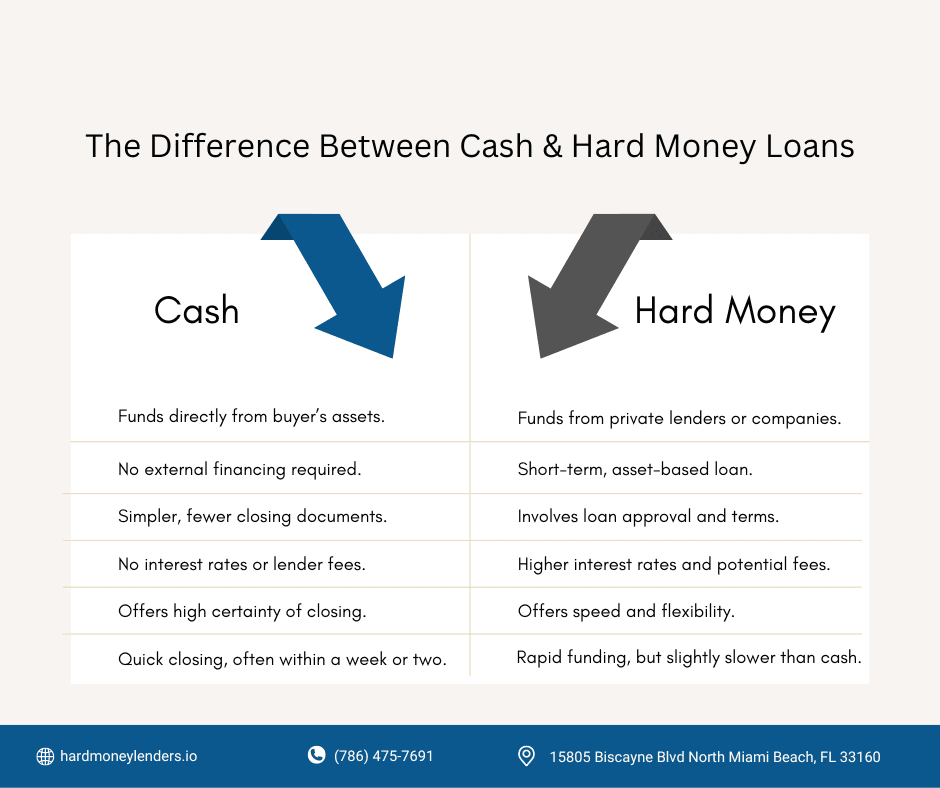

A difficult cash funding is a kind of financing protected by genuine residential property, largely used by capitalists and programmers for short-term financing requirements. Unlike typical lendings, which count greatly on a consumer's creditworthiness and revenue, hard money loans concentrate mostly on the value of the collateral-- generally the realty being funded. This makes them a sensible alternative for people that might not get traditional funding because of bad credit report or time restraints.

Difficult cash lendings are generally offered by exclusive loan providers or investment groups, permitting even more adaptability in terms. The approval procedure is typically quicker than that of conventional financings, often taking just a couple of days, which is specifically advantageous in fast-paced realty markets. Finance amounts can vary substantially, typically ranging from a few thousand dollars to several million, depending upon the property's worth and the lending institution's plans.

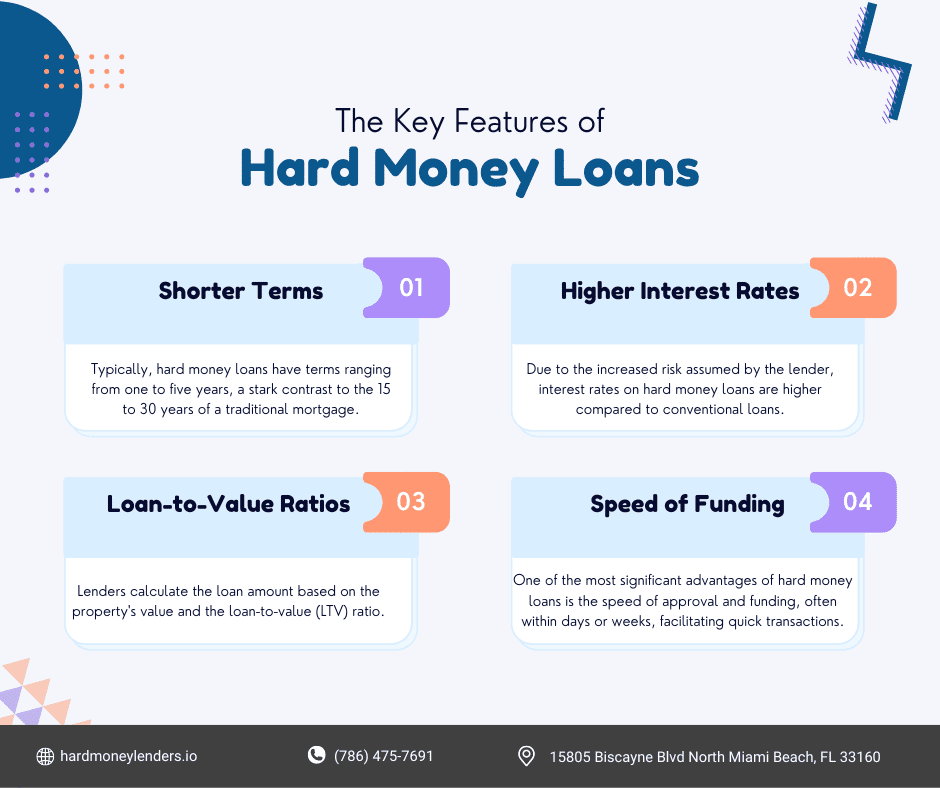

Commonly, these fundings bring higher rates of interest and much shorter repayment durations, generally ranging from one to three years. This economic tool is particularly helpful genuine estate capitalists looking to get, remodel, or flip residential properties promptly, exploiting on market opportunities that might not come through conventional funding techniques.

Key Advantages of Hard Cash Finances

Difficult cash financings provide unique advantages that can be particularly interesting actual estate financiers and developers. Among the most significant advantages is their rate of authorization and funding. Unlike traditional financings that may take weeks or months, tough cash lendings can often be protected within days, allowing capitalists to capitalize on time-sensitive possibilities.

Additionally, hard cash lenders concentrate on the worth of the residential or commercial property as opposed to the customer's credit rating. This can be advantageous for investors who may have less-than-perfect credit score or those wanting to finance properties that need considerable improvements. The flexibility of hard cash lendings permits for creative funding solutions customized to the certain requirements of the job.

An additional secret advantage is the capability to leverage homes for bigger investments. Financiers can make use of hard money loans to get several homes or to fund major improvements, eventually optimizing their return on financial investment. Finally, hard money fundings normally have fewer guidelines and less stringent requirements than traditional financing, making them an attractive option for those looking for quickly, flexible funding in the affordable realty market.

Common Conditions

Fees are additionally an important element, with origination charges commonly ranging from 1% to 5% of the lending quantity, and extra closing expenses might apply. Hard Money Loans In Georgia. Settlement terms can differ, however lots of car loans click for more info are structured with interest-only payments during the term, complied with by a balloon repayment at maturity. Security is generally linked directly to the realty asset, providing protection for the loan provider

Moreover, borrowers need to be prepared to supply paperwork regarding their financial standing and the building's problem. Understanding these terms allows capitalists to make educated choices and to engage properly in the hard cash offering procedure.

## When to Use Hard Cash Car Loans

Capitalists frequently turn to hard money loans when time is of the significance, specifically in competitive realty markets. These lendings are normally refined swiftly, enabling buyers to seize opportunities that might or else escape. When a home remains in high demand, having accessibility to rapid financing can be a considerable advantage, enabling financiers to make competitive offers without the hold-ups connected with traditional financing.

In addition, tough cash loans are optimal for buildings that might not qualify for conventional financing, such as those needing comprehensive renovations or those with unconventional building types. Hard Money Loans In Georgia. Investors wanting to repair and turn homes commonly count on these car loans to protect quick financing for both acquisition and improvement costs

In addition, difficult cash fundings can be useful for those wanting to take advantage of on distressed properties or repossessions. In such circumstances, timing is crucial, and the capability to shut swiftly can bring about raised visite site productivity. On the whole, difficult money loans work as a useful funding alternative for capitalists that need quick accessibility to funding and are prepared to leverage their genuine estate ventures successfully. Understanding when to make use of these finances can significantly enhance a financier's approach in the hectic property landscape.

Prospective Dangers and Factors To Consider

While tough cash financings offer quick funding and versatility for real estate financial investments, they are not without their prospective dangers and considerations. One considerable issue is the greater rate of interest rates associated with these loans, which can vary from 7% to 15% or even more, depending upon the loan provider and the regarded danger. This can bring about substantial prices over the lending term, especially if the investment does not produce fast returns.

Additionally, lending institutions may call for a considerable deposit, generally around 20% to 30%, which can stress liquidity. The lack of regulative oversight in the hard money offering market may likewise reveal consumers to aggressive practices if they do not conduct thorough due persistance on lending institutions.

Conclusion

In final thought, difficult money car loans serve as an important funding choice for genuine estate capitalists seeking quick accessibility to funding. These fundings prioritize residential property worth, enabling people with varying credit scores backgrounds to utilize on time-sensitive chances.

Unlike standard car loans, which count greatly on a borrower's credit reliability and income, difficult money loans concentrate primarily on the value of the collateral-- generally the actual estate being funded. Unlike standard finances that may take months or weeks, hard cash lendings can often be secured within days, permitting capitalists to capitalize on time-sensitive possibilities.

Hard cash lendings are largely short-term car loans, normally varying from six months to three years, made for fast accessibility to capital. Rate of interest rates on discover this info here tough cash financings are usually higher than standard lendings, typically dropping between 8% and 15%, mirroring the greater risk taken by lending institutions.

In general, difficult money finances offer as a practical financing choice for financiers that require quick accessibility to capital and are prepared to leverage their actual estate ventures efficiently.

Report this page